kaufman county tax appraisal

Courts and Public Safety. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

![]()

Tax Info Kaufman Cad Official Site

City of Forney 101 Main Street East Forney TX 75126.

. You can view submit and manage your forms all in one place. The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. You can call the Kaufman County Tax Assessors Office for assistance at 972-932-4331.

Its county seat is Kaufman. The median property tax on a 13000000 house is 235300 in Texas. Houston St PO Box 819.

Ad Stop Procrastinating - Get Matched To Top Rated Local Appraisers Today. 3805 W Alabama St 8106 Houston TX 77027. May I pay my taxes by phone in Kaufman County TX.

Contact information for the following CAD Districts are as follows. Kaufman County is a county located in the US. Try using the Advanced Search above and add more info to narrow the field.

PO Box 819 Kaufman TX 75142. Kaufman County collects on average 2 of a propertys assessed fair market value as property tax. The median property tax on a 13000000 house is 260000 in Kaufman County.

You can pay your property taxes by calling 1-800-2PAY-TAX 1-800-272-9829. Seeing too many results. Improving and maintaining the accuracy and uniformity of appraisals of all property in Kaufman County.

A convenience fee of 229 will be added if you pay by credit card. Kaufman County has one of the highest median property taxes in the United States and is ranked 251st of the 3143 counties in order. To view or submit a new form click on Available Forms below then choose the form you.

Search Any Address 2. County tax assessor-collector offices provide most vehicle title and registration services including. Use just the first or last name alone.

Within this site you will find general information about the District and the ad-valorem property tax system in Texas as well as information regarding specific properties within the district. Having trouble searching by Address. Skip to contents Early voting for the City of Forney runoff election is June 6 - 11 and June 13 14.

Vehicle Registration 469-376-4688 or Property Tax 469-376-4689 Kaufman County Tax Office Locations. After authorization of your payment you will be given a confirmation. There is a fee of 150 for all eChecks.

As of the 2010 census its population was 103350. Find results quickly by selecting the Owner Address ID or Advanced search tabs above. Request Cash offer.

At the prompt enter Jurisdiction Code 6382. Property Not Previously Exempt2022 Low Income Housing Apartment Capitalization Rate. Explore how Kaufman County imposes its real property taxes with our in-depth guide.

Registration Renewals License Plates and Registration Stickers. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044.

Property Not Previously Exempt2022 Low Income Housing Apartment Capitalization Rate. Congressman from Texas who was the first Jewish person to. VALUES DISPLAYED ARE 2022 PRELIMINARY VALUES AND ARE SUBJECT TO CHANGE PRIOR TO CERTIFICATION.

Contact your local County Appraisal District and they will be able to assist you with any exemption qualification questions. Click HERE to see days times and the location. The fee will appear as a separate charge on your credit card bill to Certified Payments.

KAUFMAN COUNTY APPRAISAL DISTRICT. They are maintained by various government offices in Kaufman County Texas State and at the Federal level. They are a valuable tool for the real estate industry offering both buyers.

Kaufman - County Courthouse Annex 100 N. 3950 S Houston St. Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents.

See Property Records Tax Titles Owner Info More. These records can include Kaufman County property tax assessments and assessment challenges appraisals and income taxes. Information provided for research purposes only.

The grant denial cancellation or other change in the status of an exemption or exemption application. Property Not Previously Exempt2022 Low Income Housing Apartment Capitalization Rate. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. The median property tax on a 13000000 house is 136500 in the United States. Property Tax System Basics.

Please contact the Appraisal District to verify all. Contact Information 972 932-6081. Box 339 Kaufman TX 75142-0339.

If you have general questions you can call the Kaufman County. Try a more simple search like just the street name. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing.

If you are contemplating moving there or just planning to invest in the countys real estate youll come to know whether the countys property tax statutes are. Welcome to Kaufman CAD Online Forms. Email protected For Sellers.

To submit a form and to view previously submitted forms you must have an Online Forms account. Kaufman County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Kaufman County Texas. Get connected with Kaufman County reputable property tax consultants in a few clicks.

The eligibility of the property for exemption. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing.

Having trouble searching by Name. The minimum convenience fee for credit cards is 100. The Real Estate Center-Data for Kaufman County.

Both the county established in 1848 and the city were named for David Spangler Kaufman a diplomat and US. Please call the assessors office in Kaufman before you send documents or if you need to schedule a meeting. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

Certain types of Tax Records are available to the. You do not have to have a registered account to view forms. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

Kaufman Central Appraisal District. REDUCE PROPERTY TAXES.

Valentine S Sale Kaufman County Texas Discounted 14 939 40 Off Of Market Texas Vacant Land Sale In 2022 Texas Land For Sale Valentines Sale Land For Sale

Forney Mayor Files Suit Against County Appraisal District Business Inforney Com

Kaufman Central Appraisal District Facebook

Comanche Cad Official Site Comanche Tx

Property Tax Protest Form To Quickly File Protest

Homestead Exemptions 101 Jca Realtors North Texas Real Estate Professionals

Public Info Kaufman Cad Official Site

File A Protest If Your Residential 2022 Property Taxes Are High

Public Service Announcement Residential Homestead Exemption

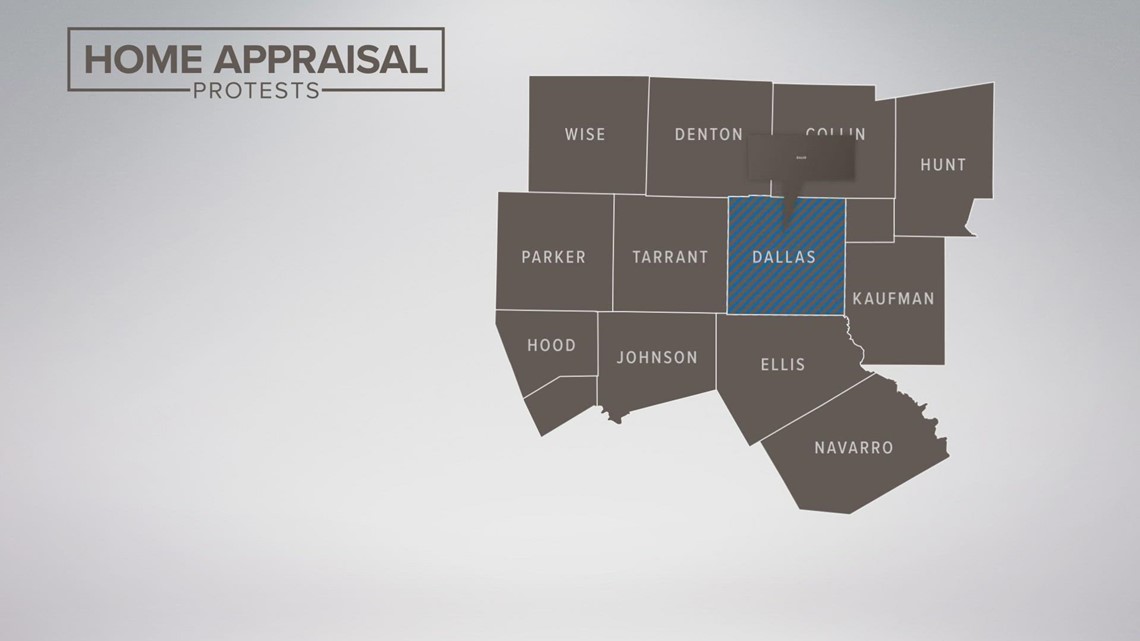

Over 250k North Texas Homeowners Have Protested Their Property Tax Appraisal So Far Wfaa Com

Kaufman Central Appraisal District Facebook

Don T Forget To File Your Homestead Exemptions Appraisal Home Trends Home Hacks

Part 1 Winning Against A Corrupt Texas Property Tax System By David Watts Jr Medium